For healthcare plans, Bronze is less expensive except in a narrow range of care usage

Short version: the $200/month additional premium for a Silver plan (vs Bronze) almost never gets recouped through the lower copays. (Remember, although you hit your lower Silver deductible sooner, you still pay 20% of all costs until you hit the out of pocket maximum, which on the Silver does not happen until your expenses hit something like $12,500. But on Bronze, once you hit $4000 in expenses your coverage in 100%. The extra premium for Silver, combined with paying out of pocket until you hit $12,500, is the one-two Silver sucker punch.)

Long version: For those of you deciding which ‘color’ version of healthcare plan to choose, there is a very high possibility that the Bronze is less expensive. This guy does a detailed analysis which, despite being a few years old, definitely applies in my case. http://ideas.4brad.com/surprising-math-obamacare-levels-go-…

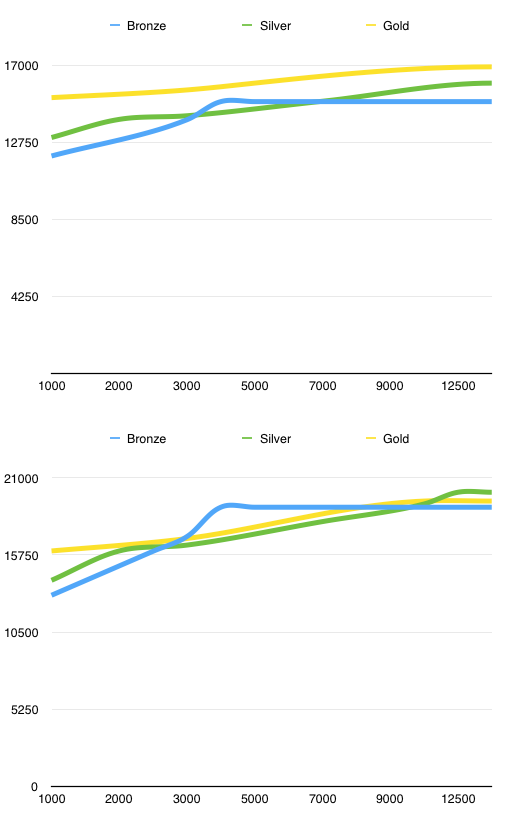

I did my own spreadsheet for our employer BlueCross plans and found that by the time you factor in premium costs, Bronze was less expensive for anything other than the case where covered medical expenses fell into the narrow range of 4000-6000 for the year (and even then, in that narrow range where Silver was less expensive, Bronze only cost a couple hundred dollars more than Silver).

The top chart is the usual case where only ONE subscriber incurs the medical expense on the X axis (and the other subscriber is generally healthy), the bottom chart is if BOTH subscribers use the same level of medical expense.

Caveat: If your “member cost” (the insurance allowed amount) for prescriptions is significantly higher than your Silver co-pay, that difference in effect “adds” to your premium cost for Bronze. For example suppose you are on Silver or Gold right now and every month you take XYZ, and on your insurance claim each month you see the Provider (retail) cost for XYZ is $600, the insurance allowed cost $320, member pays $20. Your copay benefit in this case is saving you $300/month vs the normal insurance-allowed rate for that drug.